salt tax deduction news

The Supporting Americans with Lower Taxes SALT Act sponsored by US. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

. In 2018 Trump placed a cap on the SALT deduction in order to recover revenue lost from various tax cuts. At least hes trying. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

Late last month The Hill reported that Senate Democrats scrapped their push to expand the state and local tax deduction known as the SALT write-off from a. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately stated taxable income or loss was welcomed by taxpayers and their advisers.

Tom WilliamsCQ-Roll Call Inc via Getty Images More On. Economists say it would benefit those living in high SALT districts which include. Now the SALT tax cap is set to expire in 2025.

Not in these quarters. Since 2018 taxpayers living in high-tax states have been unable to take an itemized deduction of state and local taxes over a limitation known. 52 rows The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax.

Republicans established the 10000 cap on the SALT deduction in an effort to raise revenue to help offset the cost of tax cuts elsewhere in their 2017 law which reduced the corporate tax rate. The deduction cap should be fully eliminated but Hill haggling may just raise it to a higher number say 15000 or 20000. SALT deduction in the news.

And while its presently due to sunset in 2025 Suozzi should. The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year and increase the deduction cap for Americans who make up to 1 million.

As long as you can substantiate the. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year. However many filers dont know.

A group of House Democrats pushing to lift the SALT cap most of them from New York and New Jersey insisted Wednesday the deduction is progressive and that the 10000 cap created in the 2017. If youre claiming a SALT deduction with a sales tax component you may use one of these two methods. In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for.

In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction. As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to 80000 into the House-passed.

House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state and local property. The Tax Cuts and Jobs Act placed a temporary cap on the SALT deduction and that cap is set to end after the tax year 2025.

To help pay for that increase SALT deductions were capped at 10 000 per. House Speaker Nancy Pelosi L has defended raising the 10000 cap on the state and local tax SALT deduction.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

The Impact Of Eliminating The State And Local Tax Deduction Report

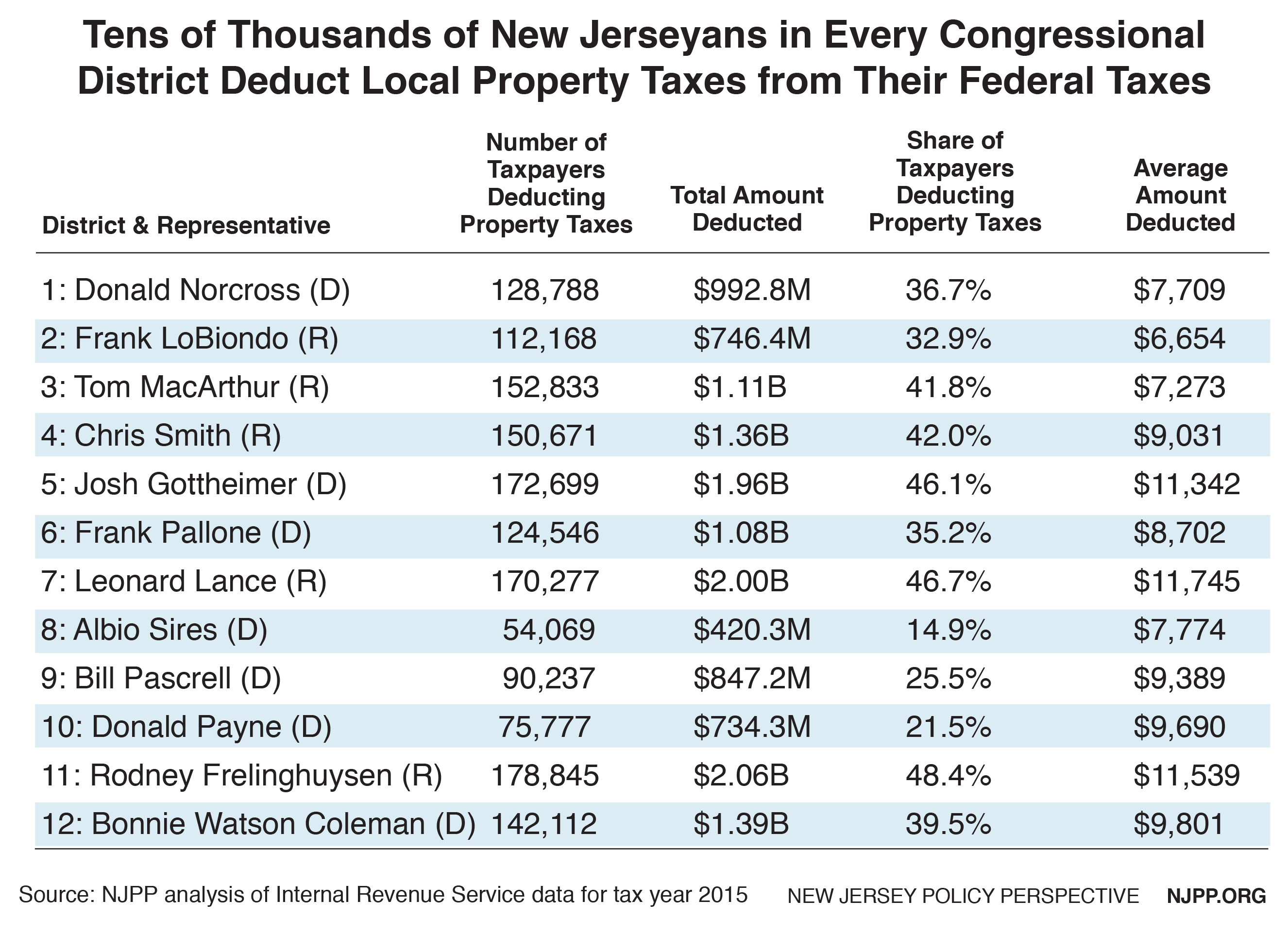

State And Local Tax Deductions Benefit Tens Of Thousands Of New Jerseyans Of All Incomes In Every Congressional District New Jersey Policy Perspective

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

This Bill Could Give You A 60 000 Tax Deduction

Coping With The Salt Tax Deduction Cap Cpa Practice Advisor

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

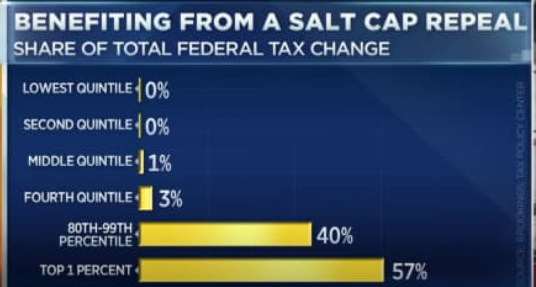

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Legislation Introduced In U S House To Restore The Salt Deduction

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

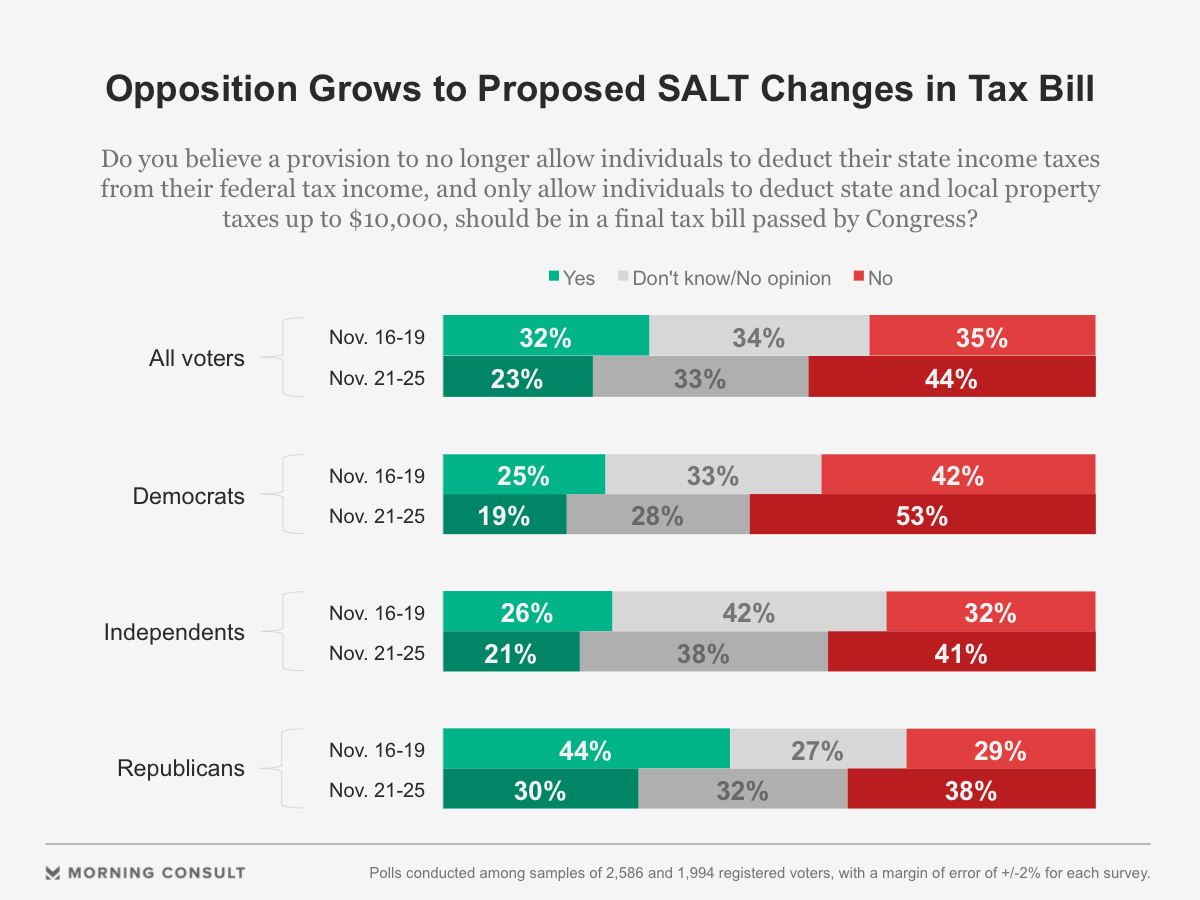

Voters Increasingly Oppose Proposed Salt Deduction Changes

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation